Irs Definition Of Off The Shelf Software

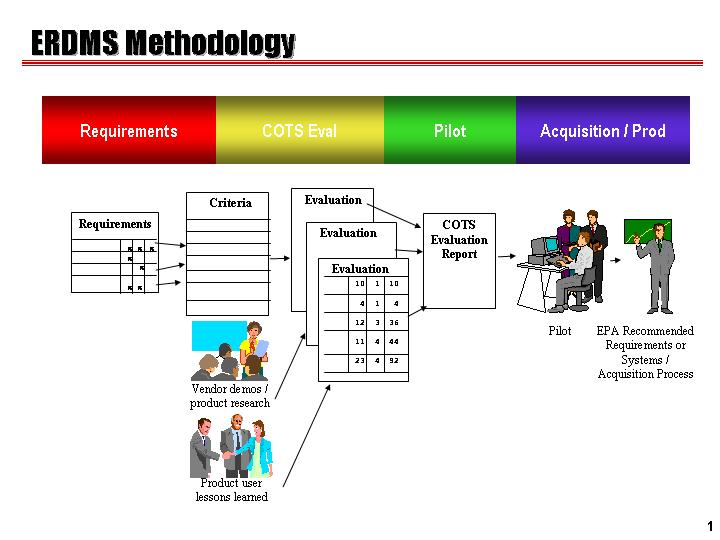

Commercial off-the-shelf (COTS) is a term that references non-developmental items (NDI) sold in the commercial marketplace and used or obtained through government contracts. The set of rules for COTS is defined by the Federal Acquisition Regulation (FAR). A COTS product is usually a computer hardware or software product tailored for specific uses and made available to the general public. Such products are designed to be readily available and user friendly. A typical example of a COTS product is Microsoft Office or antivirus software. A COTS product is generally any product available off-the-shelf and not requiring custom development before installation.

Modified Off-The-Shelf MOTS Definition - Modified off-the- Shelf (MOTS) is a type of software solution that can be modified and customized after being. Any tangible item not consumed within one accounting cycle (typically a year) and providing long term utility is referred to as a Fixed Asset. United States. Internal Revenue Service. The VCI system is a menu-based microcomputer data analysis system which IRS district office analysts can easily use. The purpose of the VCI system is to. More costly minicomputer). Also, we used commercial 'off-the-shelf ' software to design and program the user interface.

Compared to COTS, a custom designed product is typically more expensive and not as dependable. This is because the product is industrialized from scratch in minimal time with a limited budget. COTS that is modified by a purchaser, vendor or other party to meet customer requirements become modified off-the-shelf (MOTS). Generally once a COT is modified, it is the responsibility of the consumer to manage changes to the product. Procuring COTS products has become a necessity for several big businesses. It is typical for a large organization to incorporate various COTS products into its system for better functionality, as well as being a relatively risk-free investment. Showgirls 2 Rapidshare Files.